The War Against the Federal Reserve

Not satisfied to juggle a potential war with Iran along with the ongoing Russia-Ukraine war, the Trump administration is now laying siege to a much more domestic target: Federal Reserve Chairman Jerome Powell.

Starting with Federal Housing Finance Agency (FHFA) Director Bill Pulte, who tweeted over a dozen posts asking for Powell to resign on June 18th:

President Trump himself piled on yesterday, June 19th:

It’s exceedingly rare for a President to say anything about a Federal Reserve chairman… let alone to call him names. It’s also rare for Presidents to discuss interest rate policy at all.

There’s been a broad assumption if not a formal arrangement that is supposed to keep the Federal Reserve independent from the Federal Government, and to remain apolitical and neutral with a sole focus on its dual mandate of low inflation and full employment.

Of course in reality, the Fed is a part of the US Government. There’s a superficial barrier between the Fed and elected officials, and we could be about to find out that it’s flimsy enough to cave to political pressure.

The real problem is that Powell is constrained in every direction. Raising rates causes all kinds of issues – and relatively speaking, he’s been the MOST aggressive rate-raiser in the history of the Fed and possibly of any Central Banker. He raised rates from 0.08% to over 5% in less than two years.

(Chart: Federal Funds Rate)

The much revered Paul Volcker raised rates from ~10% to 19% over 18 months – which is a big move, but proportionally, it’s nothing compared to Powell.

Powell might have acted too late to prevent runaway inflation in 2022, but he faced massive inertia. Reversing course after what was basically a 40-year trend in falling rates, killing the bond bull market and eventually taming inflation is a significant feat.

Gold Royalties “Retirement Portfolio” Crushed Buffett by 18,034%

Gold royalties outpaced the S&P by 183X since 2007 – compounding wealth at 34% per year. How? It’s thanks to a special business model not available in any other industry. No mining risks. No storage fees. Just pure compounding in the world’s most trusted asset.

Go here to get details on my three free top gold royalty picks

— before new banking rules force gold back into the system.

Cutting rates presents Powell with a slew of other problems. For one, the Treasury still needs to auction off ~$4 trillion worth of Treasury Securities in 2025. Doing so at current rates has been a mixed bag. We’ve seen weakness at Treasury auctions with long term rates at 5%. Cutting rates to 4% or even lower is not going to bring more people to the table.

If people are fleeing the US dollar company store for gold and other assets when bonds yield 5%… why would they want to own bonds at lower yields? They wouldn’t.

Lowering rates too quickly could also push inflation into overdrive. Stock prices are already back to all time highs. Gold too.

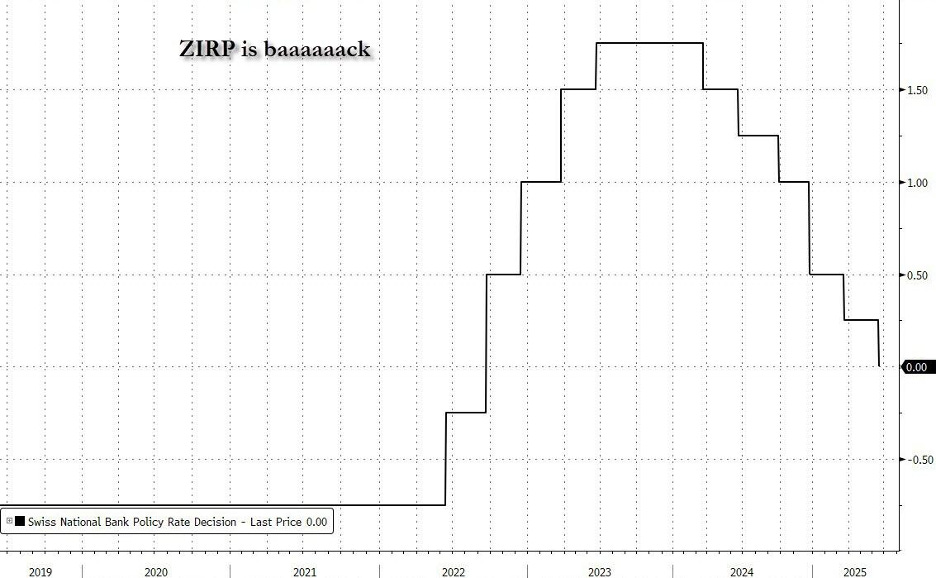

Even more concerning for the dollar is that public spats between the President and the head of the Fed do not instill confidence for investors. Trump might be right about Powell being too late. European banks have cut rates – some of them back to zero interest!

The Swiss Central Bank just took their rates down to 0.0% for the first time since 2022. Maybe it wouldn’t be the end of the world if Powell cut rates a tad here in the US…

And Powell might be right to remain cautious about cutting rates too quickly. Who in their right mind would want to back up the truck of Treasury securities at near-zero rates again after what happened last time? Many banks are still sitting on 40%+ losses on bonds they bought in 2020 when rates were at record lows…

Both Trump and Powell have valid reasons and arguments for their interest rate preferences. But that’s not the real issue right now. Investors prefer stability to uncertainty.

The path forward for the dollar is downstream of Powell’s choices and even more downstream of Trump’s tweets. You can’t make long term plans about your dollar holdings under a scenario where the Federal Reserve Chairman is being publicly insulted and asked to resign. There’s no way to know what kind of policy will prevail over the next month, let alone the next 30 years.

Which is why gold is still holding strong.

It’s the only monetary asset that is outside of the control of Central Bankers and Presidents. The big critique is that it doesn’t do anything. But in a world when you just want your capital’s purchasing power to hold steady, not doing anything is a massive benefit that no fiat currency can come close to claiming.

Best,

Garrett Goggin, CFA, CMT

Lead Analyst and Founder, Golden Portfolio

P.S. The case for gold is solid – but I think the real opportunity is not in the physical metal itself, but in a specific sector of gold stocks. These companies have a long history beating the market with less risk than any other gold stock you’ve heard of.

Earlier this week I put together a free briefing on my favorite 3 specialty gold stocks you should own today.

All you need to do: click here to see my full write-up.