Trump v Elon

US debt going bigly

The relationship between Elon Musk and Donald Trump seems to have soured.

For our purposes as investors in the gold space, the prickly details of their fallout are not important. The big issue for us: Musk’s ambitious DOGE project has fizzled and it seems unlikely that the US budget will see any real cuts.

In fact, I predicted this project was doomed before it even started. Back in January of this year, I wrote:

“History shows countless attempts to cut federal spending, but they rarely succeed.

Even with Elon Musk and his Department of Government Efficiency (DOGE) leading the charge, achieving real spending cuts remains nearly impossible.

You see, government inefficiency is baked into the system—it’s not designed to work like a profit-driven business.

Unlike private companies such as X (formerly Twitter), governments aren’t motivated by competition or the risk of losing money.

Instead, their incentive is to spend as much taxpayer money as possible to maintain power and grow budgets they can control.”

That means we’ll see a continuation of ever larger deficits, funded partially by tax receipts, but increasingly by outright inflation.

And while it may be tempting to wade into the political cat-fight for juicy details about why Trump and Musk are on the outs, that’s ultimately not useful for our investment thesis. It might actually be a harmful endeavor.

That’s because as investors, we must divorce ourselves from pet causes, peeves, political dramas, emotional outbursts and personal vendettas.

If you’re throwing money at an investment out of fear, hope, greed, or malice, you’re probably also ignoring the fundamentals. That means you’ll only succeed by luck, not by the virtue of your investment thesis.

Right now, our investment thesis as gold investors just got stronger. The chainsaw budget cuts necessary to reel in the deficit (let alone the outstanding debt) have been whittled down to a nailclipper’s worth.

Which means the Federal Reserve will be increasingly forced to outright monetize Treasury securities. In layman’s terms, that means the Fed will create dollars out of thin air to buy Treasuries. That’s the nightmare end-game for the dollar that could lead to massive inflation. I don’t see how they get around it.

Note that everyone from Trump to Treasury Secretary Bessent to Fed chair Jerome Powell all signal that they want lower rates. And they haven’t been able to make it happen. The bond market shows signs of anemic interest in buying bonds at current rates… which means rates will have to rise in order to entice buyers back to the auction table.

In the meantime, Bessent just instructed the Treasury to step in and buy back Treasuries in an effort to stem the tide of higher rates.

The Treasury injected $10 billion this past Tuesday, buying back mostly short dated Treasuries.

This injection into the bond market by the US Treasury was the largest in US history.

But the problem is far bigger than $10 billion. In 2025, the US Treasury is scheduled to sell over $9 trillion in Treasury securities. Stepping into buy $10 billion here or there is not enough. And it’s also not sustainable.

If the Treasury had $9 trillion laying around, it wouldn’t need to sell bonds.

But it doesn’t have anything close…

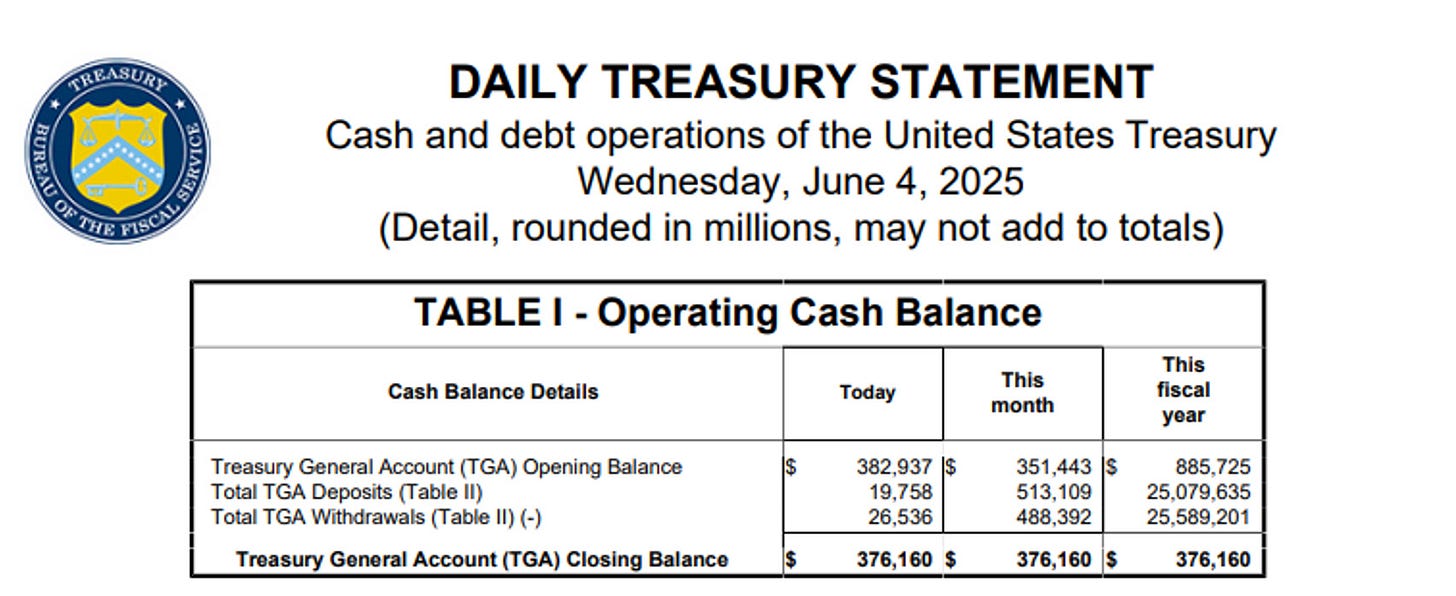

The Treasury regularly reports its cash holdings. Right now the most recent report is from Wednesday June 4th.

I grabbed this screenshot from the Treasury report:

It says the Treasury General Account currently holds $376 billion.

It does not have the cash to continue to sop up Treasury securities.

In fact, the only real asset the Treasury has close at hand is gold… but until it revalues gold (much higher) that gold is not doing much to help the Treasury’s balance sheet.

Bessent has previously talked about monetizing the balance sheet – which many people take to mean that he will revalue gold to some sky-high number.

That could help the Treasury, and it would also be a major boon for gold investors.

The next big Treasury bond auction (20 and 30 year bonds) happens just a week from today. It was bad enough that there’s no real cuts to the budget. Now the bond market also has the background of a public spat between the President and one of his closest advisors to consider before it decides to risk money with US Treasuries.

We’ll see how the world responds next week.

This ugly spat could result in an even uglier bond auction.

To re-cap: the Treasury is now stepping in to buy up bonds in an effort to curtail rates. Last month, the Fed also stepped into buy Treasuries for the same reason. And unless the Treasury very quickly revalues gold, it simply does not have the cash on hand to put a significant dent in the trillions of Treasuries that will be sold over the next 6 months.

That’s the real issue. This Trump-Musk spat is a sideshow to a real, intractable fiscal and monetary disaster that centers gold as the only major beneficiary.

Have a great weekend,

Garrett Goggin, CFA

Chief Analyst & Founder, Golden Portfolio